Chris Pirnak - The Start of a Financial Bloodbath

August 15, 2018

Direct Link to Latest News

August 15, 2018

John C said (February 6, 2018):

Ever since the four-page memo was released last week, the markets have been driven down by the Deep State and financial manipulators to destroy President Trump.

They rather see Trump destroyed than see US prosper. The establishment is evil and powerful while civil war within our own government from both the left and right battle against the Trump Administration.

There was 550 billion dollar electronic run one of the real reasons for the financial crisis in 2008. As long as, Trump battles forces of evil see the markets getting worse before they get better. The algorithms steal money within Wall Street while spoofing the markets an example is the gold market.

Greg B said (February 6, 2018):

Hells Bells, one could make the argument that ALL financial crisis in the US--even those in the 19th Century--are manufactured. They've only gotten worse for the proletariat since the immoral and illegal FED was spawned. It's the same story time and again; the insiders and the FED blow up the bubble, then bail out with their wealth intact before the bubble is popped. The insiders walk away with fortunes, while the GOYIM get sent to the slaughterhouse.

Then the same SOB's use that wealth to buy up properties, businesses and industries for pennies on the dollar and the FED starts juicing the economy again, and the whole noxious epidemic takes off again.

And it will continue this way until Americans get wise and rise up to get rid of these parasites or until the Big One completely drains the system of life. And with the GOYIM Powell as FED figurehead, this time might be the Big One.

Mohammed South Africa said (February 6, 2018):

its almost funny when i see uncles & cousins staring intently at the screen when the financial news comes on...all that talk of the DOW & futures & commodities & a certain currency being bullish or a certain firm shares being in the black or trading in futures etc(forgive me if i got any of that wrong- its not like i care too much to get it right either)

at one stage i also thought that this is the stuff that intelligent people paid attention to...then i learned that its all fake.and the biggest fool was the person who believed he was the more intelligent person for taking this stuff seriously.

Real wealth/money is something you can hold, see, feel etc, its not just ones & zeroes on a computer screen.

let's not forget that the ONLY reason paper money came into existence was that it's not easy to carry around a whole lot of gold & silver coins. Paper money was just a receipt for your gold or silver coins that you got from the bank (Jewish owned, of course).

they kept your money & charged you a little fee for their service.

these bankers soon realised that people began depending on these receipts from the bank & took it for granted that their REAL money was safe.

after that, it was just a matter of time before they realised how easy it was to gain control of the REAL wealth & fool the goyim into believing that the worthless pieces of paper that they held, had any value- moreso when fractional reserve banking came into effect.

the solution is simple- go back to how it was.

every note has to be backed by confirmed amounts of gold or silver & each country should print its OWN money without any Reserve Bank being involved.

actually, all the Reserve Banks should be blown up-preferably with the bankers inside.

TONY B said (February 6, 2018):

What this man is espousing is the common end result of creating money as debt at usury, a commodity to play with by those with more wealth than they can ever use. But he's an economist playing the game, he will never see beyond the debt trees the true money forest.

If it is true that 50% of U.S. dollars are out of the country and those owning them are selling them - to whom are they selling them? Why would they flood back to the U.S.? Would not the people want to sell them get stuck with them for lack of buyers?

And if these unnecessary dollars do come back into the country the easy answer is for the government to confiscate them - and if the bankers who own them don't like it, jail them, to hell with them, the PEOPLE matter, not them.

After confiscation, BURN THEM. Problem solved.

Then quit playing the Rothschild cabal game of an international currency and simply keep the proper amount of dollars circulating to take care of NATIONAL exchanges, a stable amount, a stable value of the dollar. Prosperity. But you can't do that with debt as money as people are forever trying to pay that impossible debt thus constantly reducing the amount of debt in circulation forcing forever new and bigger debt to keep the wheels turning.

Still we can have prosperity IF the government creates new dollars and SPENDS them into circulation as MONEY, NOT DEBT and promptly jails ANYONE who attempts to profit from control of the medium of exchange. Real money is not a commodity for sale, it is a coupon representing wealth to ease transactions. Real money is not "paid back" but STAYS IN CIRCULATION AT NO COST TO ANYONE, just like the Lincoln greenbacks did until the criminal bankers got them out of circulation.

The bankers have been sticking it to the people forever, NOW IS THE TIME TO STICK IT TO THE BANKERS and let the people who create all the real wealth anyway, keep it for their own use for once. Prosperity.

Real money is simple to understand, that's why not a single college educated "economist" will ever understand it. They insist that money is "bank credit," the computer blips of MANUFACTURED DEBT AT USURY with which "bankers" (satanic criminals) hold up every last human being on earth.

Fitzi said (February 6, 2018):

Just when Chris Pirnak seems to be on the right track, he reveals his cards as another Zerohedge-like, "alt-media" Trump cheerleader—there to give us tiny bits of truth blended in with chunks of propaganda. Fear is a big sell, especially in the patriot movement. The worship of Trump is an even bigger sell in the patriot movement these days. But it wasn't always this way.

Say, whatever happened to the days when the patriot movement avoided partisan politics because it was aware that both Right and Left were controlled by the same snake? Apparently, we all lost our memories in 2016 when that card-carrying Democrat buffoon Trump announced he was going to run for the bankers...err Republicans.

So tired of the disinformation and fear mongering. Really, it is so obvious now to anyone who truly sees what is going on.

--

Fitzi

Yours is a pretty narrow perspective if you ask me. Trump was a tiny part of this article.

h

JG said (February 6, 2018):

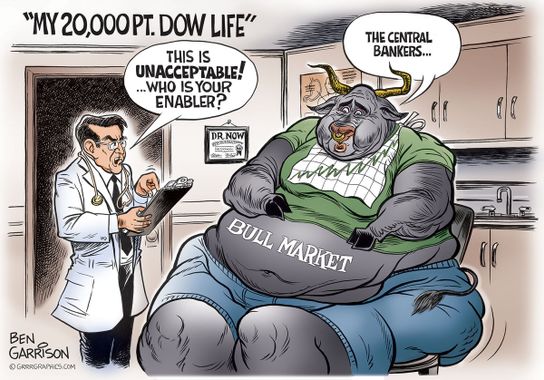

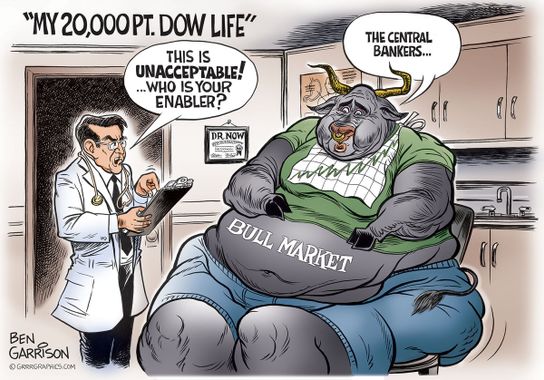

When the stock market started to tumble early in George W. Bush's first term market analysts recommended to leave the Wall Street alone and let the market correct itself. They didn't, instead, the Fed infused it with cash and has been doing so ever since. This gave the Fed total control of the market well beyond just controlling interest rates. Also, this is why the Dow Jomes numbers no longer reflect the state of the economy on "main street".

The American Stock Exchange is no longer the safe conservative investment under the control of Anglo Corporate America it once was. Today, the stock market is a casino of inflated numbers juiced and controlled by the Fed.

The market today is much like a Ponzi scheme. These fictitious inflated numbers were designed to increase investment. But, with enough profit taking, the house of cards will collapse.

Henry Makow received his Ph.D. in English Literature from the University of Toronto in 1982. He welcomes your comments at

Eric B said (February 7, 2018):

I think what immediately precipitated Friday and Monday's bloodbath was Trump's release of the Republican FISA memo. TPTB may have retreated a bit as word is that Trump will allow the release of a competing Democratic memo. The bottom line though is that the Deep State is willing to tank the economy if necessary, although I suspect there are Deep State FACTIONS that don't want to go this route.