Dutch Barter System Challenges Bankers

November 3, 2009

"Believe it or not, but De Nederlandsche

Bank (Dutch central bank,) run by Nout Wellink who is on the board of

BIS and a member of the Trilaterals) shut down my on-line telebank

service. A clear sign I was on the right track :-). "

"Believe it or not, but De Nederlandsche

Bank (Dutch central bank,) run by Nout Wellink who is on the board of

BIS and a member of the Trilaterals) shut down my on-line telebank

service. A clear sign I was on the right track :-). "By Anthony Migchels

info@gelre-handelsnetwerken.nl

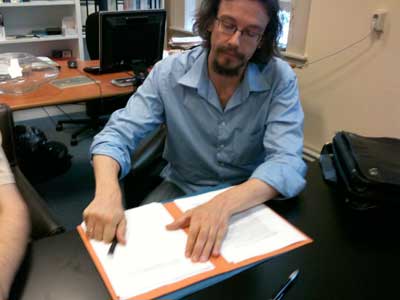

My name is Anthony Migchels and I am the initiator of the "Gelre," the first Regional Currency in the Netherlands.

My organization is a foundation, not for profit, not a company, because I believe credit should be a public facility, serving the people that actually OWN the credit, instead of milking them dry with what is rightfully theirs. The Gelre foundation is run by a board of three.

We now have almost a hundred companies participating and the break even point should come at about 300, after that we can get an income out of it. But the real goal is, to hook up 66% of all companies in Gelderland, a province in the Netherlands with 1.2 million inhabitants and 60k companies. A GDP of about 40 billion Euro.

It is clear that interest bearing debt to a bank as money is a vicious hoax, but strangely enough, few have been developing a viable alternative.

Ellen Brown and the Money Master people, whom I both regard very highly, have reasonable

propositions, but they are still considering reform at the state-level and that is simply not going to happen. Not here in Europe and not before having survived WW3, anyway.

State Level real money implies the end of the New World Order Central Banking Vampires.

There is Bernard Lietaer, but his biggest point seems to be that 'complementary currencies' complement the 'national' (banking, really) currencies. He has correctly analyzed the negative aspects of interest, but is completely oblivious (or pretends to be) to the nefarious nature of the powers behind the printing press. It is clear that real alternative currencies have only one goal: to destroy the credibility of humanities greatest plague and its metal based successors. The goal is clearly NOT to play second fiddle.

I like Thomas Greco, who is very knowledgeable. He suggests mutual credit, facilitated by Market Players as a solution, but even he has not pinpointed what is to my mind the most crucial challenge for anybody wanting to create a viable currency, able to truly compete with Dollar or Euro

That challenge is as follows:

Barter units allow for interest free credit, but are not convertible to major currencies and convertible units don't allow for non interest bearing credit.

Combining these two features, convertibility and interest free credit, is essential for non state/non bank monies to have a real impact.

It is the way of the not so distant future :-)

Most barter schemes have prohibitive transactions costs. Also, and even more importantly, they are not convertible to Euro/Dollar. They usually are OK for swapping excess inventory or goods and services with low marginal cost, but not for high powered capital intensive industry.

The Euro/Dollar/Pound based Berkshares (http://berkshares.org/) , Lewes Pound

(http://www.thelewesPound.org/) and German Regional Currencies (www.regiogeldverein.de) are stronger, because they are based on national currencies: you give up a Dollar and in return you get a Berkshare, that can be spent within the network. In effect the Dollar remains in the network. Because there is a Dollar in the bank, companies can convert excess local currencies (units that they cannot usefully spend in the network) to Dollar/Euro The problem is, there can never be more of the local currency in circulation, than the supplying organization has Dollars/Euro in the bank. Therefore they cannot supply any credit.

This is also the basic architecture of the current Gelre. Another conceptual problem with this approach is that you are basing real, loving money on the most toxic commodity known to man: interest bearing bank debt as money.

There is also a legal problem here, in Europe, anyway:

Believe it or not, but De Nederlandsche Bank (Dutch central bank,) run by Nout Wellink who is on the board of BIS and a member of the Trilaterals) shut down my on-line telebank service. A clear sign I was on the right track :-). They did so because of a prohibition on collecting 'reclaimable money' (a direct translation of judicial lingo, I'm not sure an English speaking lawyer will know what this means).

You can, however, manage reclaimable money if you give a paper voucher in return. This is a loophole designed for book vouchers and the like.

Now we have only paper money in circulation. Of course, this law is to 'protect consumers' (wink wink). You have to realize this was going on last year, 2008. The people from the Dutch Central Bank are telling me they are very worried about the couple of thousand Euro that we manage as deposits for circulating Gelres. The same people that have been supervising and in effect organizing the credit crunch that has cost taxpayers in the west trillions

of Dollars.

Now, being confronted by men and women (kind and intelligent people!) in expensive suits destroying and enslaving the people I love, including myself, who are telling you they are protecting consumers by putting me out of business, kind of pisses me off BIG TIME.

Brainwashed or not, you start to dislike them even more than you already did.

Its probably not the same with everybody, but if somebody starts playing with my family jewels,

smiling all the time and speaking very correctly gets me thinking. To be honest, it was an experience that inspired.

By creating a unit that combines both strengths, cheap credit AND convertibility, we believe it is possible to actually compete with Euro Creating money out of thin air that will buy Euro and eventually gold, it sure gets me excited :-)

We'll buy the world back :-))). we won't, but the people using the Gelre will!

The only problem is: how to do it and inspiration makes answering this elusive question easy: you create convertibility not by reclaimable deposits, but by creating an open marketplace where your unit can be traded!

In this way, you create convertibility not by having Euro or Dollars deposited, but by more classical means: foreign exchange markets have been around for quite some time, but only for bank money Speculation is out of the question, because in the network 1 Gelre=1 Euro always.

My foundation simply always sells Gelre for 95 cents, so it is no use offering your Gelres for more.

And because 1 Gelre has a purchasing power of 1 Euro in the network, there is always a natural demand for Gelre because its buyer gets a de facto discount of at least 5%.

Of course you want a stable rate for the Gelre, close to its target of 0,95 cents. This is achieved by correctly managing the amount of Gelre you issue. If you issue to many, people will dump it on the market and your unit goes down the drain: nobody will accept it if its rate goes down too much.

But you can, and we have, create a stabilization fund. Because we sell Gelre for 0,95 cents, we have Euro. We could simply pocket them, but then we would be ripping off the system. It would be a goldmine. Nobody would even notice, people are gullible, but the idea is to help, not to steal. No, the Euro we get in this way go into the stabilization fund and we use them to buy back Gelres if the rate goes down to much.

In effect this means we can almost guarantee a stable exchange rate. Almost, because every adult has to awaken to the fact that there is only one guarantee in life: you die.

It is childish to look for guarantees from institutions. That is part of what is called 'arrested

development'.

At this moment we are programming the on-line exchange. Its not complicated at all, thankfully.

Naturally all this needs to be managed correctly. And of course the idea is very simple. But also revolutionary. A breakthrough that has the potential to create very powerful currencies that can compete globally and locally in many diverse networks against the far to expensive (because of interest) '(supra)national' currencies.

We have chosen a regional scope, because one of our main goals is to stop centralization of power. Since most local economic area's are 80% self sufficient, it is natural that they are monetarily as well.

And because 'The study of money, above all other fields in economics, is one in which complexity is used to disguise truth or to evade truth, not to reveal it' and also because 'the process of money creation is so simple, it repels the mind' transparency is essential in any real money system.

Therefore we have created the Gelre monitor, which reports real-time to all parties involved, on-line, all the key indicators of the Gelre. Turnover, amount in circulation, percentage that is taken by the issuing organization for costs, number of participants, etc, etc. All this information will be available with just a few mouse clicks.

End of this year, maybe early next, our new system will be on-line, hopefully. And it is going to work. Despite the many unknowns to the public. You know why?

Because we are going to print some money and GIVE IT AWAY!

We are going to give away millions of Gelre (1 Gelre = 1 Euro). Why not? We print it for nothing! We don't use that money to stuff these piggybanksters, but we hand it over to the people!! And they can spend it at the businesses that join. These businesses can actually convert their Gelre income to Euro (at a small cost).

We are going to play Santa Clause and all that money is going to circulate forever, continuing to create business. A skyrocketing Gelre Economy in the depths of a very severe depression.

Nobody can get a Eurodime, but we give away millions of Gelre!!

Of course most of the Gelres we put into circulation will be lent out (without interest, but of course with some (very cheap) price, we have bills to pay) in a mutual credit kind of scheme, or sold for Euro (for the benefit of the stabilization fund), but a reasonably small percentage can be simply given away.

You know, the Dutch have a reputation, well deserved, for being the Jews of the Gentiles. If GIVING THEM MONEY FOR NOTHING is not going to convince them, I'm just gonna give up and let the wolves do their thing.

As a final note: one of the most painful delusions many well informed and well intentioned people suffer from, is that the problem is paper money. And that gold is the solution. It is not. Gold is controlled by the same scoundrels that control the current printing presses.

The problem is inflating and deflating an interest bearing money supply. By fraudulent criminals. This is the same for gold as it is for paper. Where do people think all the depressions before 1913 came from?

Of course, gold DOES have a function as the great, eternal tell tale of paper manipulation. That is why it has been manipulated at an unimaginable scale. If it had not been, gold would probably already be at 5k Dollars per ounce. Real inflation (as opposed to the FED figures) has been that bad, the last few decades.

But as a means of exchange it is worthless. Impractical and with an unstable, non-transparent supply. Stable, transparent supply is a core indicator of high quality money.

To be honest, the bankers couldn't care less about the paper, if they can replace it by gold.

Money is one of the few commodities that we can produce infinitely at virtually no cost. The art of the trade is to create plentiful money, without overdoing it. Even a limited amount of inflation is OK, as long as people are aware of it, are compensated for it and don't save the money.

Saving money is always a bad idea anyway, because it withholds money from circulation, but that is another story.

The point is, that if you have a reasonable entity issuing the money, its supply will be stable and cheap.

The Gelre will also prove that gold is as big a hoax as is interest bearing debt.

You can tell I'm excited about it, I can hardly believe we are actually going to do this, and sometimes I am afraid, not only of success, but also of the banksters.

We are going to do it, though.......

---

PS

Your publishing of the article last week has produced dozens of reactions! Very inspiring. So much so, I opened a blog in which I intend to participate in the debate on currency.

I will be focusing on monetary matters, not so much on the wider conspiracy which is very competently handled by other people, you in particular.

I believe the subject is of such crucial importance (banking being our masters core business), that we have to get it out of the way, at least within the aware part of the community.

For your info: the blog can be found at realcurrencies.wordpress.com.

-------

Barter Systems Booming--Time Mag

Money Myth Exploded

Tad said (November 10, 2009):

Regarding the Dutch Barter system,

you might be a bit careful spreading information about frauds around by way of promoting those frauds. The Free Banking version of community currency may be well intended but it is dangerously mis-informed. See Elaine Supkis's commentary on this story at http://emsnews.wordpress.com/2009/11/07/dutch-guys-want-to-print-their-own-funny-money/ I know that Stephen Zarlenga would object to having his name in any way associated with this scam. It is effectively advocating a practice that was known as "free banking" in the US which had a very high level of fraud associated with the practice. Yes, golobally we need to reform the privatized monetary systems, and this sort of example will end in discrediting that effort. Is that what you want? The whole discourse associated with community currencies has a lot of this pop-level economics that ends up being a a major problem. The pint should be to emulate a reformed monetary system, not to go into competition with the current frauds by doing pretty much the same thing that the frauds are doing. There are ways to emulate a reformed currency system and to reduce currency scarcity, without creating more problems.

--

I appreciate the inclusion, and if you could attach the url for Re-Imagining Economics at http://www.economic.arawakcity.org My prime disagreement with Stephen Zarlenga is that he dismisses the educational value, potentially, of community currencies and exchange systems in favor of solely advocating for reform at the national level. The co-option of good intentions by the free banking subversion and rampant pop-economics, in place of genuine economic and financial literacy seems like a self hobbling process. I would strongly recommend Peter North's Money and Liberation as a much more realistic treatment.