Home Prices Ready to Crash?

April 27, 2017

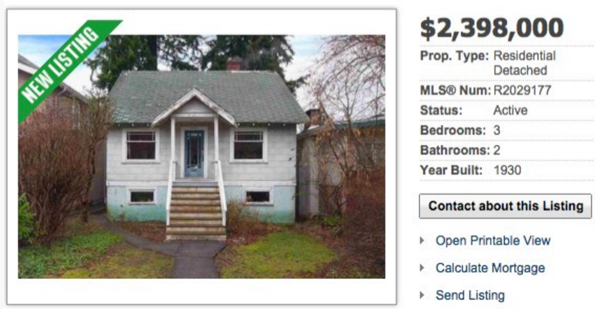

(left, Vancouver)

House prices are going through the ceiling in many large urban centres worldwide. But UK-based contributor Sandeep Parwaga

warns that this presages a crash.

(Editor's Note- I don't agree with the assumptions expressed below. A house is an excellent investment, although not in inflated markets. As long as interest rates remain low, I don't see a crash. Posting this for a change of pace.)

by Sandeep Parwaga, PhD

Robert Kiyosaki famously said ''A house isn't an asset, it is your biggest liability'. It seems to be a hidden truth many haven't heard of. In the Anglo-American sphere, people are thought-trained that owning a property is the highest aspiration in life. I realized what a fraud this was. Tragically, this belief encouraged the 2008 mortgage crisis, and may be fuelling the next.

Nothing has changed today, as debt-based bubbles have bloomed all over again, including in the car loan, student loan, and housing sectors. Are we facing another disaster? The housing market is yet an old but familiar indicator.

GLOBAL HOUSING MARKET IN A BUBBLE

The global housing market is in a state of total madness. Prices have been going up irrationally over the years. With real jobs and wages declining, it becomes harder for younger, first-time buyers to purchase their own home. At first sight, I thought that this would never change, but there may be something sinister on the horizon. The situation is reminiscent of the pre-2008 crisis. It is happening all over the world, including in the UK, USA, Canada, and Australia. A couple of factors has fuelled this situation.

- Quantitative easing and low interest rates have caused the flow of large amounts of capital into the housing market and lead to a massive increase in prices. When interest rates will inevitably go up to counter inflation, the consequences will be horrendous for the housing market.

- Though banks claimed to have tightened their lending rules, it doesn't appear to be the case. Loose lending is still a problem in the housing market which inevitably increases the number of sub-prime mortgages on an immense scale.

- Investors are an integral part in the dynamics of the housing market. When they sense that things turn against them, they could be the first to exit early. I predict we will continue to see this happening, as government policies make it less attractive to be a property investor. Fund freezes have returned in the UK at several fronts and are yet another worrying sign. Also, as the economy in foreign countries stymies, foreign buyers will eventually decline as well.

- The market thrives on supply and demand. Unfortunately, this has become a massive illusion. People are less and less able to afford a house. How can demand be going up? Besides the demand side being a fraud, I suspect the supply side is too. Banks have loosened their lending rules to construction companies again that are building properties which will eventually sit empty. China is famous for this and may be a lesson for the future. The central bankers need to keep the housing market in an artificial supply and demand scenario to keep the game going, including through schemes as in 2) and 5). Any downturn could lead to a crash.

- Government help: In the UK, the government rolled out the help to buy scheme, which allows buyers to only put down a 5% deposit. It doesn't take a genius to see that this is absolutely crazy as these buyers are massively over-leveraged.

- Prices will eventually see a stagnation and decline, like it is starting to happen in the UK, China, or Canada. The price can't go up forever, and has to have some relationship to the reality of average people. People who took out mortgages on high house prices could get suckered once this happens. Owners would be paying more on their house than it will be worth, called negative equity. This could be another flashpoint.

WHY IS A HOUSE NOT AN ASSET?

Some may have been curious with the above quote from Kiyosaki. If this would be taught and spread it could change people's attitudes towards property, and prevent future disasters. Let me give some points to explain the quote.

- a house, in reality, is like a car. You use it and therefore it depreciates its value. Unlike cars where the price only goes down, house prices are going up due to market forces i.e. central banker policy, not due to its inherent value.

- An asset, to my knowledge, does not bring with it the high maintenance costs in order give it a value. A house is a major liability due to its maintenance costs.

- An asset generates wealth. As above, a house over time costs you on top of the basic commitments. Therefore a house cannot be termed an asset.

- Let's say you own your house and rent it out. Ok, the rent generates wealth. But if something disastrous happens to the house and it requires substantial amounts of funds to fix, part of the initial wealth generation will inevitably go to fixing the house. You lose the wealth and are back to or near zero. Tenants may also be unreliable with payments. Hoping that this doesn't happen is speculation, which is not a characteristic of an asset.

- You own your house and are seeing a massive increase in the price over the years. You made a profit. As highlighted above, this is mainly due to market forces. This is in par with a speculative gain rather than a sound asset.

CONCLUSION

The bubble phenomenon has engulfed the housing market again. I am sensing that when the housing market unravels, it will be crashing worldwide and be worse than 2008. Collateralized debt obligations have returned in the UK, USA (even under new names), and Canada. And like in pre-2008, they may be a warning sign that something is going to happen. I'm not an expert by any means, but it is quite obvious that we have been indoctrinated and mislead on a massive scale. The mentality that we should all own a house because a house is an asset is logic defying, and it is time that people get informed because it can change tragic outcomes. I am not saying a house isn't a great thing. I want to own my place too, but one has to be realistic about it. See it as your dwelling, not an investment.

Not everyone will be able to ever afford a house. The winners in the market are those that are informed. Unfortunately many will be hurt. As for me, I will wait for the circus to unwind, have little to no debt, and in the meantime invest in safe assets and save the money to buy my place outright. So before you commit to a house at this time think hard, and don't assume that things will stay as they are, because they won't.

Related - Economist Michael Hudson on Housing Bubble

Inside Job: https://youtu.be/

World Alternative Media: https://youtu.be/

Max Keiser: https://youtu.be/

First Comment from Jerry:

Your piece on the housing nonsense reminds me of a quote by none other than Paul Warburg who said:

"The world lives in a fools paradise based upon fictitious wealth, rash promises and mad illusions. We must beware of booms based upon false prosperity which has its roots in inflated credits and prices."

Whatever Warburg was he was no fool watching as he did the crash of the roaring 20's. I think we are all going to wake up to a world very different from the one we went to sleep in any day now? Reminds me of the scripture:

"Look, I come like a thief! Blessed is the one who stays awake and remains clothed, so as not to go naked and be shamefully exposed." Rev. 16:15

Sandra writes:

Oh, please. What is this business about buying a house as an "investment" we never hear the end of? We need a place to live, right? If we do not buy a house, then we will have to rent one or else rent an apartment, unless one enjoys all the advantages of residing under a bridge. There are no other options. Couch surfing with one's spouse and family? I don't think so. This was barely touched on.

The disadvantages of renting are just as numerous as owning your own house, if not even greater. You are still paying for the repairs and taxes, only it's indirect. A landlord can decide he wants to re-do all the suites in an apt. block, which happened to someone I know. Total renovation even though the suites were all perfectly livable and in good condition. (I've seen some of them.) The tenants were not given a choice whether or not to have their particular suite renovated. The increase in rent was ghastly and quite a few of the tenants are old people.

Suppose large numbers of people decide to heed the advice that buying a house is a "poor investment". Where do they go? Who do they sell their house to, if nobody wants to be a homeowner? Who's going to own all those houses and apartment blocks? Are a few very rich people going to come along, buy up everyone's house, and then rent it out to them? Instead of dealing only with the government (who you pay your house taxes to), you then have to abide by the landlord's endless rules and regulations, too. If you want a dog or a cat, you'll have to pay extra rent, for just one example, if they let you have one at all.

There's no free lunch. Life is hard and staying alive is expensive.

Thanks for listening. As you can see, this topic is like waving a red flag in front of a bull where I am concerned.

Chad said (April 28, 2017):

This article is not factoring in the bazillions of Chinese who’re feverishly buying properties in the United States. More specifically, California. So long as someone can pay the mortgage and with the competition for homes increasing, you won’t see a crash any time soon.

In my part of the country, the Chinese are driving the prices of even a dump to over a million dollars. Where does it end? Are Americans getting priced out, likely. This is why you see controls in countries such as Canada and Australia, limiting foreigners from going whole hog on property purchases.

I’d suggest this article primarily applies to the domestic audience. Rich foreigners? Eat your hearts out.