Anthony Migchels -How Money Rules

July 29, 2018

The World is run by the Banking Cartel,

which is the real hegemon, not some Nation State.

When Banks rule, it is obvious that they rule through money.

Here is how they do it.

By Anthony Migchels,

(henrymakow.com)

How we know the Banks rule

Let us first ascertain that the Banking Cartel is indeed the hegemon. And this can be proven by one simple statistic: the World is indebted to them to the tune of $247 Trillion Dollars. That is three times World GDP.

This debt costs about $12 Trillion per year to service, which is about one-sixth of World GDP. It is known that all this money ends up with the richest 10% of the people worldwide. Even much worse: about a third of this money (about 4 Trillion) ends up with the richest 0,0032%. These are the people that control the Banks.

Compare this to the income of the US Federal Government, which sits at a paltry $3 Trillion. US Government debt to the Bank is about $21 Trillion, and US total debt (including households and corporations) is perhaps as high as $70 Trillion.

Not only is the Government's income markedly lower than that of the Banking Cartel, it is dependent on them for money.

These numbers are self-evident. They expose the true nature of power, and they also show how ridiculous it is to speak of 'economic growth' and 'wealthy countries'. Obviously, the United States cannot be 'rich' when it has $70 Trillion (3,5 times GDP) in debt. There will be wealthy people in the US, yes, but the country itself is poor and broke, as is also proven by the fact that 80% of Americans own nothing, and live paycheck to paycheck.

Besides the obvious implications of the massive debt, it has been established that all the major Banks in the World (European, American, Chinese, Japanese) own each other. They ARE a cartel. It's not speculation, it's a fact.

CONTROLLING THE MONEY SUPPLY

To control means to be able to start, sustain, and stop something. Banks control the money supply. They create the money; they decide how much money there is, who gets it, and they destroy the money (when debts are repaid).

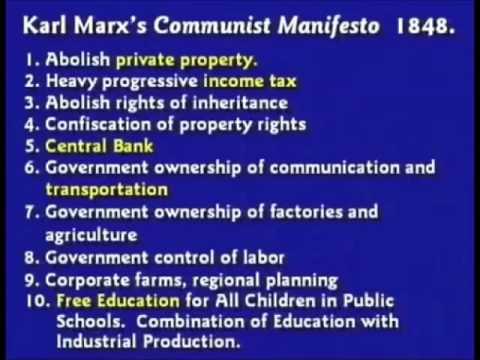

(#5 ROTHSCHILD BANK. "Government" is just a proxy for Rothschilds. Absurd that an ideology that seeks to destroy democracy and enslave society should have legal status.)

And they control all the money supplies in the World. Including that of Syria and Iran. And North Korea. Which is not surprising, as the Communist Manifesto demands ´the centralization of all credit in the State, by means of a national bank and an exclusive monopoly'.

Libya seems to have been the last country with monetary independence: Gaddafi ran an interest-free monetary system, with the issuing organization securely in his own hands. People got interest-free loans for business ventures and mortgages.

When the 'rebels' (Zio-Capitalist-Wahhab proxy goons) were still a bunch of startups in Benghazi, the first thing 'they' (in reality their sponsors in the State Department) produced was a charter for a Central Bank.

All 'national' currencies worldwide, are created in the same way: as an interest-bearing debt to the Bank. Which is noteworthy in itself, because there are many natural ways of creating currency, and this uniformity is a key tell-tale sign of centralized control.

It is sometimes hard for people to fathom why money is so incredibly crucial in the economy, but it's really very simple: money is half of all transactions. The seller provides goods and services, the buyer provides money.

So on the one hand, there are all the goods and services in the World, on the other hand, there is the money.

Money is the gateway to everything else. Without money, most transactions would not take place. By controlling the volume of money, one controls price levels in the economy. By keeping money scarce, one creates artificial scarcity of everything.

By controlling money, one controls the entire economy.

HOW THEY TRANSLATE CONTROL OF MONEY INTO CONTROL OF EVERYTHING

Here are the three main Banker tools of exploiting control of money:

1) Usury, which is interest on loans of money.

2) Creating inflations and deflations, the boom and bust cycle.

3) Credit allocation: Bankers decide who gets money, and who doesn't. They control who can invest, and in what.

We have already seen what damage Usury does: working people pay $12 Trillion per year to the idle classes, parasites who inherit billions and suck up billions more in interest, without ever producing anything that is of use to anybody.

(Anthony Migchels)

Usury is the main driver of debt. The last 25 years or so, States, Corporations, and individuals have paid more interest than they currently have debts outstanding. Without Usury, there would hardly be any debt.

By controlling the volume of money, both in the general economy and in specific markets, they control all price levels. Yes, ALL price levels, in all markets. Even Oil (the biggest market) they can just increase prices tenfold in a matter of moments. They did this in 2006-2008. This is true of all assets and commodities.

By lending liberally, for instance for speculation on the Stock Exchange, or real estate, they create booms, inflations causing higher prices. Next, they cite 'lack of confidence', or 'bad fundamentals', and stop lending, which diminishes money in the market, and lowers prices, leading to busts.

During the busts, most people are forced into liquidation at depressed prices. Only the Plutocrats have enough money to pick up the pieces for pennies on the dollar.

The 2008 Credit Crunch alone has created about $50 Trillion in damages worldwide (bailouts plus missed economic growth). Unsurprisingly, the wealthy became much wealthier in the last ten years, while working people (the 90/99%) saw income and asset positions decline massively in real terms.

And last, but not least, the Banker privilege of deciding who gets credit: the implication of this is obvious: the absolute worst people in the World get to decide who gets money, who can invest, and in what. Therefore, Bankers decide in what direction society will develop. So obviously we have mass poverty, people working 50 hours per week, 50 weeks per year while having nothing. That is how the filthy rich like it.

When Bankers decide who gets money, then the Fed can just print $16 Trillion for Bank bailouts, while politicians will tell everybody we can't afford food stamps and social security.

CONCLUSION

Yes, the Bankers rule, and they rule through money. They prey on our ignorance. We don't understand they are a Cartel (a Monopoly), we don't understand how they create the money, how they set all prices, how Usury automatically concentrates all wealth with the very richest.

But once one does understand the problem, the solution is obvious: take control of the money supply; create usury-free credit; manage volume to allow stable prices (which is really not complicated), and allow local communities to allocate credit for their own needs.

Note that the problem is not fixed with some Gold Standard, while they own all the Gold, and will only lend it at interest to us. The problem is also not fixed by letting the State create the money, but leave all credit (at interest!) to Banking. Cryptocurrencies are bogus items who do not solve any of our monetary problems. Mindless speculation is not going to solve Banking.

Nationalizing the Fed is also far from sufficient, and at best a minute step in the right direction. The Fed only exists to facilitate Commercial and Merchant Banking and was created by the Banking Industry.

Keep this in mind: the essence of Banking is not 'money creation' as most of the Alternative Media will tell you. The quintessential nature of Banking is lending at interest. THAT is what a Bank does, and that is how they have conquered the entire World.

Only interest-free credit can solve Banking and the New World Order.

-------

Related- Fed does not answer to President

Anthony Migchels is the founder of a start-up interest-free currency in the Netherlands and has written extensively about monetary reform and usury-free economics.

Stephen Coleman said (July 31, 2018):

Anthony Migchels gets about 80% of this right. What he is missing is actually the elephant in the living room. The National Bank created by Alexander Hamilton was not created for bankers, it was a bank for the people and by the people. Interest rates were very low, 1%, which amounts to a low tax and not usury. The interest was designed to basically cover administrative costs and not intended as profit. It was illegal to loan money for speculation.

Now to the elephant: China has instituted a National Bank following the example of Hamilton. This banking system in the last 40 years has lifted 80% of the Chinese people out of dire poverty, something that is historically unprecedented. China is loaning money that is strictly monitored for large infrastructure projects in Asia, Africa and South America. Interest rates are incredibly low, less than .5%. This makes the IMF, BIS, World Bank the obvious loan sharks they have been created to be.

The Chinese bank has the mission to lift the 3rd world out of poverty worldwide. Anthony is incorrect about Syria, Assad did indeed institute a National Bank for Syria and that is the real reason for CIA funded ISIS and the devastation his nation has suffered.

Meanwhile Sergey Glazyev, economic advisor to Putin has been working tirelessly to get Russia to institute a National Bank. Hence all the Russia-phobe press.

The western banking cartel are running terrified. their system is dying and crumbling before they eyes. Nations one by one are divesting their dollars. The banksters are doing all they can to create instability in Brazil, South Africa and anybody associated with the BRICS. It appears that the BRICS will be the new world order and it appears to be a fair and egalitarian system intended to replace the old genocidal colonial system. China is doing so and without marching armies, but instead with new highways, dams, irrigation projects and greening deserts.

Duterte of the Philippines stopped WWIII occurring over the Chinese claims to The China South Sea, thus blindsiding the banker's cartel and creating a win/win solution with the Chinese. Meanwhile, he has taken loans from China and Japan, infuriating the banker's cartel. The Philippines are enjoying a massive boom in construction of infrastructure projects surpassing the FDR TVA project.

Much more good will be accomplished if people cooperate rather than compete.