Stocks are the New Cryptocurrencies

September 8, 2018

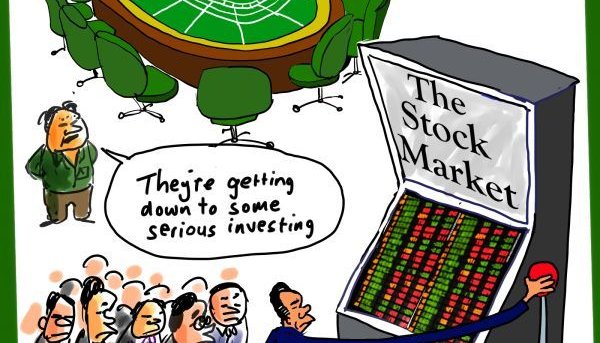

The stock market

is more evidence that

we live in a man-made

alternate reality.

by Henry Makow Ph.D.

In the past couple of years we have seen the price of a bitcoin rocket from $200 to $19,000

in December 2017 to settle at around $6400 Friday. Other cryptocurrencies followed suit although not in so spectacular a fashion.

The value of cryptocurrencies is established by what people will pay for them. They have no intrinsic value. They are not even backed by government imprimatur like fiat currencies. All of these, including gold, are media of exchange, entirely based on social acceptance i.e. "demand."

Increasingly corporate shares are behaving like cryptocurrencies, detached from the real world of earnings. In fact, the shares that do best seem to be those based on pipe dreams.

Those companies that have actual earnings and low p/e's are punished mercilessly. People are willing to pay now for what shares might be worth five or ten years from now if everything goes according to plan.

An example is Advanced Micro Devices (AMD) whose shares have tripled since March. Estimated 2018 earnings of .30 mean the P/E ratio is 94. Meanwhile, Micron (MU) is the dog at the party. It made the error of executing in reality instead of what if. It will make $10 a share this year and trades at $45, giving it a P/E of 4.5. It peaked at $61 in June.

What's going on? Micron investors must be tearing their hair out.

POT HIGH

Then there's the marijuana bubble symbolized by Tilray (TLRY). It has skyrocketed from $22 in July to $78 today. It loses money and predicts it will lose more money when cannabis is legalized in Canada, and people won't have to depend on the "medicinal" variety. It

has the absurd valuation of $7.25 billion dollars!

Tilray has hundreds of competitors. Marijuana is a weed that anyone can grow. Cannabis isn't even legal in much of the US and world. Experience shows that people who don't use it now do not rush to try it. People who do use it have their own sources. Yet numerous grow farms have valuations in the billions!

People have taken leave of their senses. A stock's movement seems to depend on its "story", not on its earnings.

In June the "Chinese Netflix" (market cap $20 billion. Loss $.73 a share) hit $44. Today it is $27.

Even household names have exorbitant P/E's. Here are some examples: Microsoft - 50.

Amazon-- 154. Netflix 158. Tesla loses $16 a share and trades at $263!

Theranos reached a valuation of $9 billion based on a blood test that turned out to be

bogus.

We are in a 1929-like bubble caused by money printing and "quantitative easing" (easy credit.) The stock market and real estate are sopping up all this money. That's why there is so little inflation, otherwise. The trouble is that bubbles keep expanding ... until they pop.

The Illuminati are Cabalists. Cabalists (Satanists) don't believe in objective reality. They don't believe in discerning God's message. They believe they can reformulate reality to satisfy their lusts, independent of reason, logic, morality or science.

Man-made reality is based on hype and fraud. We ignore the truth until it hits us in the face.

Chris Pirnak said (September 7, 2018):

You hit the marijuana industry on the head. It will never be as big as alcohol, but the cannabis shills are pumping it like the crypto shills pumped all those alt coins last year. Cryptos may be a mirage, but the blood was real.

Stock valuations are completely divorced from reality, though the companies have value.

When will it end? The Fed is moving much more slowly than anticipated. They warned us earlier in the year. I don't think most are listening. You and I know It will not end well for most people. That, of course, is done by design.