As Rothschild Freemasonry orchestrates

the third Masonic Jewish world war,

remember they also engineered the US Civil War.

Wars serve the purpose of destroying Christian civilization,

killing goyim and consolidating power and wealth in the hands

of the Masonic Jewish bankers and their Masonic minions.

700,000 Americans died in this early goyim depopulation program.

In the US Civil War, the Rothschilds hoped to divide America

into two bite-sized chunks. The 14th Amendment,

adopted on 9 Jul 1868, transformed all Americans,

whether black or white, from sovereigns to subjects,

meaning slaves or tax-cattle.

from Jan 8, 2024

by Patrick O'Carroll

(henrymakow.com)

MAIN REASONS FOR THE AMERICAN CIVIL WAR

--Re-colonization of the USA by Britain. This largely succeeded, although the USA was not thoroughly re-colonized until 1913, when the US Fed was founded as a subsidiary of Rothschild's Bank of England;

-- Partition of the USA into the northern Union and the southern Confederacy, both to be controlled by the Zionist House of Rothschild. This part failed, having been foiled largely by the efforts of Abe Lincoln;

--Certainly NOT slavery, which was a total non-issue the banksters merely deployed as a smokescreen. In fact, the upshot of the American Civil War was the enslavement of ALL Americans, both black and white;

--To transform the USA into a Slave Plantation owned by Zionist Britain. This was finalized in 1868-71.

HOW THE ROTHSCHILDS FINANCED BOTH SIDES

--The Rothschilds gave direct financing to the Confederacy, and engineered most of the financial and secessionist intrigues in the South;

--Ninety percent of the Union's financing came from its own tax-base, but the Union also got some financing from the London Rothschilds;

--The Rothschild-allied French House of Orléans also gave direct financing to the Union.

OTHER BACKING

--The Confederacy was also financed with by the French House of Bourbon and associated "Légitimistes";

--Russia's Czar Alexander II gave largely passive support to the Union, and sent an unequivocal warning to Britain not to invade the USA in 1863, when he ordered the Russian Navy's Baltic and Pacific fleets to winter in the US ports of New York and San Francisco respectively. For messing up their US plans, the British Rothschilds "rewarded" Alexander II by assassinating him in Saint Petersburg on 13 Mar 1881, and then "rewarded" his grandson, Czar Nicholas II, by stealing all his wealth (estimated at over 1 trillion USD today) and assassinating the entire Russian royal family in Yekaterinburg on 17 Jul 1918. The Rothschilds have controlled Russia since 7 Nov 1917, when they founded Russia's "People's" Bank;

--Abe Lincoln is also said to have blamed the Catholic Church, and he was quoted as saying: "We owe it to the Popery that we now see our land reddened with the blood of her noble sons".

WHAT DID THE ROTHSCHILDS WIN?

--After 1871, full ownership of the US Corporation by the Bank of England (main owners Jewish Rothschild and de-facto Jewish Windsors);

Enslavement of all formerly sovereign Americans by enactment of the disastrous 14th Amendment;

--Re-colonization of the USA by Britain, but this was not thoroughly completed until the Bank-of-England-owned Fed was formed in 1913;

--A long-awaited opportunity to destroy US Christianity, and that happened particularly after around 1919, and culminated in the Total Lunatic Asylum that the USA has become today;

--Ownership of a VASSAL USA as their lackey to wage all future empire-building wars for the Rothschilds (WW1, WW2, Korea, Vietnam, wars for Greater Israel after the Zionist attacks of 11 Sep 2001 ... and soon WW3).

Lincoln assassin, Freemason John Wilkes Booth

MAIN OUTCOME

Although the Rothschilds won the US Civil War, they did not succeed in partitioning the USA. The main upshot was that the Bank of England gained ownership of the US Corporation in 1871. The overall death-toll was about 750,000. The Zionist Rothschilds and the Zionist English monarchy still own and control the USA today.

The 14th Amendment, adopted on 9 Jul 1868, transformed all Americans, whether black or white, from sovereigns to subjects, meaning slaves or tax-cattle. Hence, REAL US Slavery was in fact LAUNCHED in 1868; and REAL slavery today is based on a superfluous central-bank, combined with income-tax and national-debt (both superfluous), all these being SCAMS for wealth-transfer from poor to rich, and for financing artificial wars and artificial "crises" (i.e. most wars and all financial "crises" after 1800 AD) and for fleecing, brainwashing, and culling the slaves. It would be wrong to view the US Civil War as "trivial" since it had truly worldwide impacts.

Until this era of 1861-71, the whole USA was a veritable PARADISE, akin to an Orderly Amish Village, and populated by sovereigns. That means that if two sovereigns needed to engage in a gun-fight, a sheriff had no right to stop them. The sovereigns had no duties toward any nonexistent "government", they only needed to follow Biblical rules. It is crucial to observe how great a disaster for all of humanity the Rothschild-Zionist victory in the American Civil War was.

WHEN THE INTERNATIONAL ZIONIST BANKSTERS ORCHESTRATED THE AMERICAN CIVIL WAR

In former times, the Rothschilds did not ALWAYS get their way as they mostly do today. It took them a whole FOUR attempts to enslave the USA:

--The Rothschilds instigated the War of 1812 in a failed attempt to force the renewal of their Charter for the (First) Bank of the United States;

--In 1836, when US President Andrew Jackson vetoed a charter for the Second Bank of the United States, the Rothschilds sent their manservant August Belmont, who arrived during the wholly instigated "Panic of 1837" and made his presence felt by buying up government bonds. His success and prosperity soon led him to the White House, where he became financial "advisor" to the US president;

--In 1857, a pivotal meeting took place in London, at which the international syndicate of top banksters decided that the northern and southern US states were to be played off against each other. This 1857 agreement was verified by John Reeves in his authorized biography of 1887 entitled "The Rothschilds, the Financial Rulers of Nations" and corroborated by Robert MacKenzie in his 1909 book "The Nineteenth Century: A History".

The banksters decided that it would be too complicated to involve France, Britain, Russia, Canada, or even Mexico, so they decided on a Civil War that was to be fought over the wholly fake "issue" of slavery.

They set up the lodge Knights of the Golden Circle under George WL Bickley, who is said to have later bragged he had "created the fateful war of 1861" by prompting his Knights of the Golden Circle to launch and push the message of secessionism throughout the southern states. If the South were to win the war, the banksters intended that each state would later secede from the Confederacy and reestablish its own separate central bank under the control of the London House of Rothschild;

--Finally, the USA's fate as a Rothschild Vassal State was sealed when the US Fed was founded in 1913.

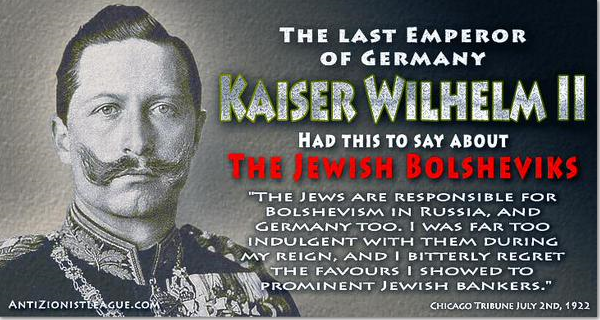

JEWISH INFLUENCE IN THE NORTH

In his 1967 book "Our Crowd: The Great Jewish Families of New York", Stephen Birmingham documents the lives of prominent Jewish families in the New York of the nineteenth century. But the biggest Mafia organizations in the North were still the Boston Brahmins and the Essex Junto, of Essex County MA.

JEWISH INFLUENCE IN THE SOUTH

During the American Civil War, the main protagonists in the South were the following four Jews:

1. Judah Philip Benjamin: Rothschild-Agent, slave-owner, and puppetician. Benjamin was a brilliant lawyer who became attorney general, the first advisor to Confederate President Jefferson Davis, the Confederacy's Secretary of War, AND its Secretary of State. Benjamin has been dubbed "the brains of the revolt".

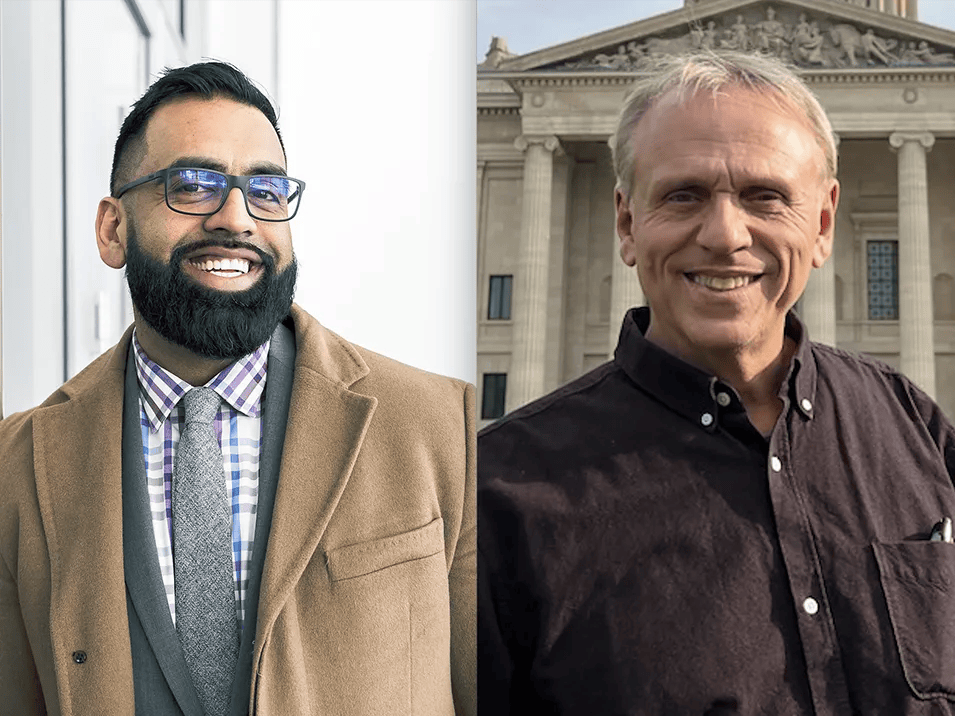

2. August Belmont, left: financier and agent of the Frankfurt and Vienna Rothschilds, who changed his surname from Schönberg, meaning beauteous mountain, to the more French-sounding Belmont.

3. Edwin de Leon: Confederate "publicity" (propaganda) manager who sought financing in Paris. One financier that paid into the Confederate Treasury was the Jewish banking house Erlanger & Cie of Paris.

4. Abe Lincoln: half-Jew of the Rothschild-Springs "Illuminati" bloodline. Lincoln was born of the illicit union of AA Springs, real name Springstein (blood-relative of London's Rothschilds), and Nancy Hanks (blood-relative of "actor" Tom Hanks), whom Springs had impregnated in 1808 in Lincolnton NC, from which they concocted Lincoln's fake surname. Springs left a very large parcel of Alabama land, corresponding to what is known today as Huntsville AL, to his illegitimate son Abe Lincoln.

In general, Abe Lincoln backed the efforts of his own Springs-Rothschild brood to gain control over the South but that task really took another 60 years. But Lincoln also opposed his own Rothschild family by printing US Greenbacks and by preserving the union. For this disobedience, the Rothschilds "rewarded" Lincoln with a bullet that was fired by B'NAI B'RITH puppet John Wilkes Booth, a member of the Knights of the Golden Circle.

The Knights of the Golden Circle were a B'NAI B'RITH-controlled lodge, whose alleged members included Albert Pike, John Wilkes Booth, Jefferson Davis, Jesse James, and Samuel Mudd (the physician that treated Booth, thus purportedly giving rise to the phrase "Your Name Will Be Mud(d)").

JK said (July 1, 2025):

In conclusion, if the Bible has been accurate in outlining future events in the case of the revived Israel and its cohort America, wouldn’t it be wise to heed all of its prophecies regarding the ‘End of the Age?’ Those prophecies include the end of pseudo-Israel, the utter destruction of America, the destruction of NATO, the failure of the EU, great calamities upon the whole Earth, all culminating in the return of Jesus Christ.