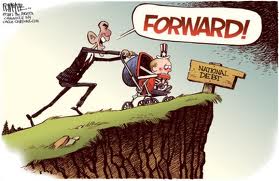

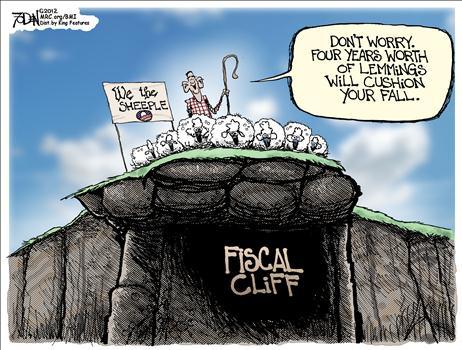

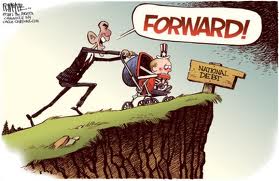

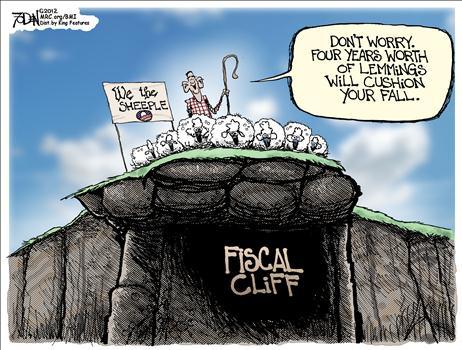

"Fiscal Cliff" - Increasingly Likely & Desirable?

November 28, 2012

Direct Link to Latest News

November 28, 2012

D said (November 29, 2012):

You're absolutely right. It is actually preposterous to believe that anyone would want to pay back banks that lent at interest, something which was not theirs to lend... rather, it was already "ours". It would be nice to see a few true patriots in the ranks of army brass whom share our views pull off a military coup, put DC on lockdown and carpet-bombthe living shit out the place, then declare that their is no debt, and issue its own interest free currency -- while declaring that if there's anyone in the world whom disapproves, they'll blow them to smitherines too. And then, they'd announce the repeal of all free trade agreements, imposition of high tarrifs on all goods imported by US-based companies with production facilities outside of the US, the nations withdrawal from the UN and NATO, and all US troops from all stations all over the world would be brought home and placed on high alert because it would only be a matter of time before Zionist forces would attempt an invasion.

I can always dream can't I?

TONY B said (November 28, 2012):

Hummmmm, we're going to have a recession in this on going depression??? Talk about depths!

Let the whole damned thing collapse. Then maybe the people will get balls enough to kill all the criminal bankers (Shakespeare had the wrong group - kill that bunch secondly and those bankers and lawyers who are also congressmen, kill them twice) and we can make a fresh start with real and honest money with a total outlaw of "credit," so-called.

Dick said (November 28, 2012):

The "cliff" is non-existent and the debt ceiling is just a number.

Yes, there is a point at which debt outstrips the ability to pay.

We may be there already (thanks to endless war, free trade and Wall Street bailouts). But the question is whether America can buy some time to fight for fundamental reform (ie national banking, a Wall Street Sales Tax, reindustrialization, etc.), or whether it should admit defeat and let the poor starve for the sake of bailing out Goldman Sachs.

If you want $600 billion+, the only way to get it now is a tax on

Wall Street transactions. Middle-class Americans pay ~7% to buy

daily necessities and ~30% income tax, yet a hedge fund operator

pays nothing to buy derivatives, and 15% on his income, which is

classified as capital gains.

I would encourage your readers to visit the United Front Against

Austerity (http://againstausterity.org), which lays out the pro-

industry / anti-Wall Street program the US should adopt. The first

step is to, as you point out, tear up the Budget Control Act and

start agitating for real reform. Deficit reduction will make the

problem worse, as the experience of pre-war Germany shows.

Henry Makow received his Ph.D. in English Literature from the University of Toronto in 1982. He welcomes your comments at

Brian said (November 29, 2012):

Oh yes, we're all goin' over a cliff, whether you characterize it as being "fiscal" or whatever other adjective you choose. For that matter, fiscal is only one aspect of the plunge we're on the brink of taking. Now it becomes a question of how hard the fall.